Uninsured bank deposits are the most vulnerable in case of a bank failure, and currently, there are at least $7 trillion held in such deposits in the US banking system. According to StockApps.com, BNY Mellon is one of the US banks with the highest levels of uninsured deposits, with 92% of its total assets composed of such deposit accounts.

StockApps financial analyst Edith Reads commented on the findings, “It is important to be aware of the level of uninsured deposits held by any bank, as it could serve as a risk indicator of its overall financial health. It is worth noting that BNY Mellon has maintained a robust balance sheet despite the high concentration of uninsured deposits.”

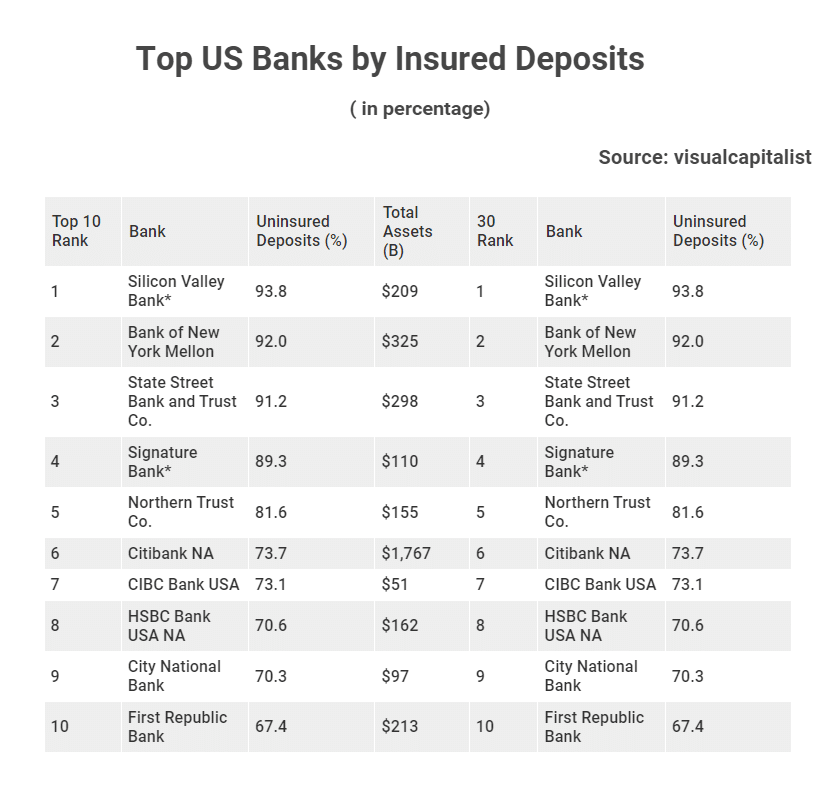

Which Banks Have the Most Uninsured Deposits?

BNY Mellon is not alone in the US when it comes to holding large deposits of uninsured funds. State Street Bank and JP Morgan also rank among the top banks with the highest uninsured deposits. The difference between these banks and BNY Mellon is that their loans and held-to-maturity securities are much lower as a percentage of total deposits.

The high concentration of uninsured deposits in BNY Mellon, State Street Bank, and JP Morgan is due to their status as custodian banks. As custodian banks, they provide critical infrastructure within the financial system by safeguarding assets and transferring them between parties. Due to their role, they have been deemed “systemically important” and therefore have an obligation to protect customer deposits.

This focus on deposits, however, does present some risk to these banks. Held-to-maturity securities pose a greater risk to banks due to the rising interest rates. When interest rates rise, the value of these assets declines. This has been seen in recent years when the value of long-term U.S. Treasurys declined about 30% in 2022 due to rising rates. A bank holding these securities until maturity will likely face a loss if they sell them before maturity.

Is Your Money Exposed?

Customers should assess the institution’s loan-to-deposit ratio and its holdings of held-to-maturity securities to identify any potential risks to their money. The loan-to-deposit ratio measures how much the bank is lending relative to the amount it holds in deposits. If this ratio is too high, the institution may be unable to cover its liabilities if there is a run on deposits.

Furthermore, customers should also assess the held-to-maturity securities held by the bank. Held-to-maturity securities are debt instruments purchased to hold them until maturity. These securities can often be difficult to sell without taking a significant loss, meaning the bank may have to take on more debt to finance its operations if it needs to liquidate these assets.

Ultimately, customers should assess the leverage a bank takes on before opening an account with the institution.

Question & Answers (0)