The primary motivation for investing is to derive profit. To that end, different people adopt several investment vehicles. Whereas some choose to buy bonds, others might venture into crypto or commodities. Yet others may choose to deposit their funds with a financial institution to earn some interest.

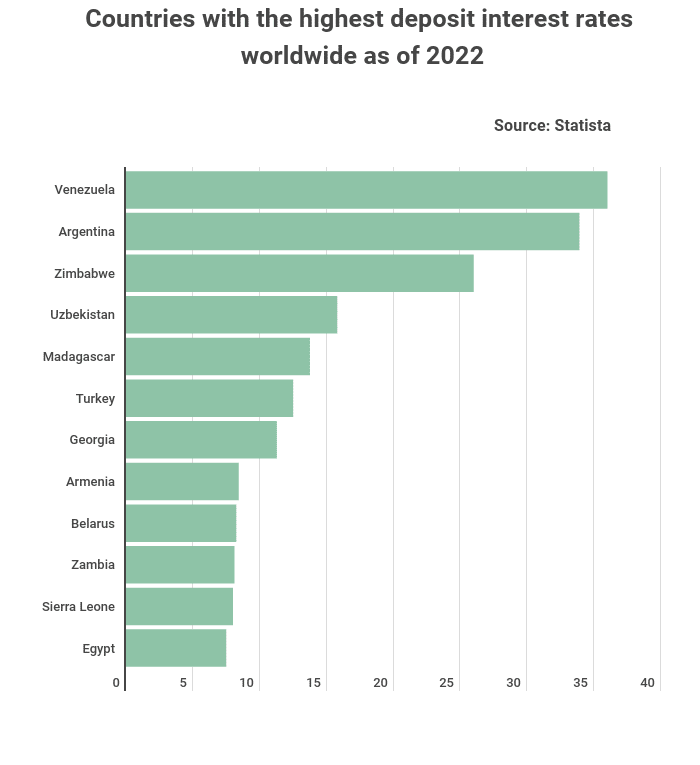

Depending on their prevailing economic conditions, different countries offer different interest rates. StockApps has been analyzing global interest rates. It concludes that at 36% per annum, Venezuela has the highest interest rate on deposits.

Commenting on the data, StockApps.com Edith Reads said the following. ” Venezuela is fighting with runaway inflation. The government in Caracas Is looking to tame that, and one means it has adopted is encouraging deposits. The thinking is that higher interest will encourage savings, thus helping it mop up excess funds from circulation.”

Edith warns would-be investors to be wary of the high interest rate trap. The high interest on deposits could lure more people into depositing funds with the banks, but amid a hyperinflationary environment, that could be counterproductive. Besides, the banking system in Venezuela has been chaotic.

Suspension on foreign currency trading

The devaluation of the Venezuelan Bolivar forced the citizens to adopt the U.S dollar for transactions. But fearing capital flight and further erosion of the Bolivar, the country’s authorities suspended foreign currency trade by private entities. Yet, Venezuelans didn’t waver in their confidence in the dollar.

As the government moved to centralize forex dealings, it created room for the thriving of unregulated dollar trade. Moreover, an odd third market space called “swap” emerged to exploit the shortfall occasioned by the government’s decision. Ironically, while the authorities prohibited trading U.S. dollars on the public markets, selling stocks and bonds overseas in return for dollars continued unchecked.

Venezuelans could buy government bonds in bolivars at brokerage firms Casas de bolsa. The brokers would then utilize an offshore business to exchange these for dollar-denominated bonds. These they’d sometimes obtain from the state at a predetermined, deliberately low amount.

The suspension led to most Venezuelans losing confidence in their banking system. Therefore, the Federal bank hatched a scheme to lure the masses back. It started offering them attractive interest on their deposits.

Sanctions by the U.S. government and inflation

Venezuela has faced sanctions from the U.S. for some time. Unfortunately, these have tended to exacerbate the hyperinflationary environment in the country.

The sanctions have had a debilitating effect on people’s incomes and purchasing power. But they have eased somewhat following the Russian incursion into Ukraine. As the U.S. needs Venezuelan oil, it has eased those sanctions. Regardless, the effects of inflation are still biting.

How are other countries performing?

Although Venezuela offers the highest deposit interest, other countries are beginning to challenge that position. For example, Argentina, a South American country, takes the second position with 33.9%. Currently, Argentina is facing inflation of about 60%, which explains the surge in deposit interest.

Zimbabwe offers the highest deposit interest in Africa at 26%, followed by Madagascar at 13.75%. The two countries are also facing tough inflationary moments and their currencies are performing poorly against the dollar.

Question & Answers (0)