DYOR Explained: How and Why to Do it

Technical analysis, AI predictions, and alternative data services are excellent for crypto trading. However, nothing beats being as informed as possible about your assets. That brings us to the popular crypto slang “do your own research” (DYOR explained).

Creators and token investors are good at hyping their projects, encouraging more buy-ins. Doing your research gives you adequate knowledge beyond the promises about crypto assets. It involves an in-depth analysis of the crypto project’s market, legitimacy, and potential.

You can use DYOR in any market, from stocks to commodities, bonds, cryptocurrency, metals, indices, etc. We will give our take on “DYOR explained,” including the best research approach. Notwithstanding, let’s begin by assessing the importance of conducting your own research.

-

-

Understanding the Importance of DYOR in Crypto

While we encourage researching traditional trading markets, we will focus on crypto. Over $3 billion was lost to crypto scams in 2022. “DYOR explained” is not only about recognizing scams but also recognizing crypto projects with the best potential.

Rug pulls are prominent in the crypto space. Crypto whales can raise hype about a project, get as many investors as possible, and sell out the token, causing a price drop. Nevertheless, some researchers and creators are still concerned with using cryptocurrency and tokenization to solve real-world problems.

As seen in this “DYOR explained” piece, you might need a tiny bit of technical skill for some projects. Notwithstanding, the overall process is simple enough for beginners. Get the right tools and research platforms, and you should be fine.

Why Relying Solely on Others Can Be Risky

Little regulation in the crypto space leaves investors exposed. Trading in regulated, traditional markets is already risky. Compare that to crypto trading, where you can use decentralized platforms without much oversight.

We know of the many hardworking creators and developers who are hoping to solve problems with blockchain technology. However, you can’t trust anyone 100% when investing. Some influencers and project leads will advise you to do your own research before investing in their projects.

Many people have lost money trusting celebrities for investment opportunities. While you push to get the best DeFi apps, remember to research your investments. Here are a few risks involved in trusting others:

- They might have inadequate knowledge of the project

- They can be paid to promote the project without doing their own research

- They might be involved in scams

- You won’t know the project’s roadmap or true potential

Fraudsters can duplicate accounts of real projects to lure investors. Without adequate research, you risk putting your money in the wrong hands.

Empowering Yourself with Knowledge

Crypto projects often have use cases and roadmaps. For utility coins, that could mean having usage in specific digital environments. For this reason, many creators have whitepapers for their projects.

That crypto game app you use now likely has a roadmap with several milestones. These maintain its relevance in the space, improving its worth as it accomplishes each milestone. Research gives you the confidence to invest.

You can easily find a project’s unique selling point in its whitepaper. Information is easily accessible to encourage investors. That’s why we don’t recommend investing in projects with shady or hidden information.

Besides researching the project, you can also learn about the team behind it. Find out as much as possible, whether on social media or specific websites. Learn about their experiences, backgrounds, criminal records, and previous projects they’ve been in.

As seen in this “DYOR explained” piece, the more knowledgeable you are, the more confidence you have. Your trading psychology will be in a better state to make rational decisions.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What Does DYOR Entail?

We titled this piece “DYOR explained how and why to do it.” That’s because we want to show you how, not just why, you should research. It goes beyond opening a few Google pages.

Two things are vital in doing your own research: what to look for and where to look. You need separate approaches for projects still in development and those that have debuted and live on trading platforms.

Beyond Surface-Level Information

Cryptocurrencies have moved beyond being payment solutions. Developers have embedded real-world utilities into their projects. VeChain is an example of a project with real-world utility in supply chain logistics (this is not a recommendation).

Determining the feasibility of a utility goes beyond surface-level information. Again, we fall back on the project’s whitepaper. This document should reveal how the project intends to achieve that utility when launched.

Researching whitepapers can help you discover the best crypto presales worth investing in. We recommend avoiding the social media hype and focusing on the project’s roadmap. Don’t invest if the process is not feasible.

Comprehensive Analysis and Investigation

You can still fall back on a project’s whitepaper even after launch. Credible projects will update their whitepapers as they reach and set new milestones. Notwithstanding, don’t invest in live projects without comprehensive analysis and investigation.

eToro Procharts are ideal for conducting comprehensive analysis. You can also use Etherscan to explore transactions involving the project that have occurred. Etherscan can reveal the presence of whales.

If you are new, now’s the perfect time to sharpen your skills in crypto trading patterns for technical analysis. Besides technical analysis, consider tokenomics, exchange listings, and market sentiments. High trading volumes during accumulation phases often indicate positive market sentiment.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Benefits of Conducting DYOR

This article (DYOR explained) is timely as people renew their interest in cryptocurrency and blockchain. Ultimately, you bear the risks of your investments. Hence, getting as much information as possible is best.

Here are the benefits of conducting DYOR:

Making Informed Investment Decisions

Our increased use of social media creates the fear of missing out (FOMO). Log in, and you’ll find several celebrities and even your friends promoting one product or another. However, going with the flow leaves you unaware of many intricate details.

You can make informed decisions with research (as in DYOR explained here). A little research can reveal unique selling points and a project’s potential. Most importantly, you’ll know how the project intends to stand out against the competition.

Mitigating Risks and Avoiding Scams

Investment is risky, no matter how well-informed we are. However, you can mitigate the risk by not being completely ignorant of an investment opportunity. Cryptocurrencies are more volatile than traditional markets, with market sentiment playing a critical role in price fluctuations.

Technical analysis can reveal periods of peak volatility, allowing you to avoid them when trading. Knowing the best time to trade crypto is as essential to mitigating risks as other management techniques.

Adequate research will help you determine the best trading strategy. For example, a crypto project might require scalping, while another requires long-term trades.

Besides mitigating risks, research can help you avoid scams. Fraudulent projects are easy to identify if you pay close attention. You can determine the project’s feasibility and identify those with bogus promises.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Setting the Foundation for Research

Let’s drop a little reminder here (DYOR explained: how to do it and why). How you conduct research determines the quality of the information you get. Hence, you must use the right approach.

The process begins with you before extending to other platforms. Emotions can influence trading decisions. That is something the Wyckoff method aimed to eliminate in stock trading.

Here’s how to set the foundation for your research:

Defining Your Investment Goals

If you’ve already outlined your investment goals, there’s no need to repeat the process. Instead, be concerned about aligning the project with your goals. Some projects are better suited for long-term investments, while others present short-term investment opportunities, like presales.

Your investment goals should include the timeframe and rate of return (ROI). Review your capital when setting goals. Ensure they are achievable and time-bound.

Capture the volatile market in your goals. Also, review market trends to get an idea of possible outcomes and long-term feasibility.

Identifying Your Risk Tolerance

The next step after setting goals is identifying your risk tolerance. Some traders can afford to lose $10,000. Avoid that level if losing that amount will leave a considerable dent in your wallet.

Ensure you have sufficient risk tolerance for the market’s volatility. You must understand that it is more volatile than the traditional stock market.

Your risk tolerance will determine your portfolio allocation. For example, you might invest more funds in less-volatile projects and less in more-volatile projects.

Evaluating Project Fundamentals

Begin your research on the project fundamentals (as in DYOR explained). This stage often reveals a project’s potential to turn a profit. Most importantly, fundamental analysis is the easiest part of the research process.

You don’t need technical tools to evaluate a project’s fundamentals. All you need are your reading skills. The two primary areas to focus on are as follows:

Understanding the Project’s Purpose and Use Case

Crypto projects gain their value from their utilities. For example, Bitcoin’s primary use case is in payments and asset tokenization. Ethereum expands to non-fungible tokens and the creation of autonomous, decentralized organizations.

Projects with better utilities can generate more interest, solidifying their profit potential. Read their whitepapers thoroughly to see their utilities and how they intend to fulfill them.

Assessing the Development Team and Advisors

The human factor is equally crucial to fundamental analysis. Hidden team members are often a red flag for scams and fraudulent projects. Legitimate projects will reveal the team’s identity and open them up for scrutiny.

A prominent developer can boost a project’s potential. For example, Charles Holskinson, one of Ethereum’s founders, developed Cardano. His presence added credibility to the project.

Pay attention to previous success. Scrutinize the team as much as possible.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Analyzing Technological Aspects

Move on to the technological aspects once you are convinced of the fundamental prospects. These represent a project’s operational infrastructure. They include tokenomics, distribution, governance, digital use, etc.

Here’s how to analyze the technological aspects:

Reviewing the Whitepaper and Technical Documentation

A project’s whitepaper contains all the technical information. You’ll find utility, tokenomics, market cap, governance, staking, etc. These details show how promising the project will be.

Some developers also have their technical documentation on GitHub and other platforms. For higher projects, you might find information on blockchain technology, consensus mechanisms, and smart contracts.

Examining the Project’s Blockchain and Protocol

Most crypto projects exist on pre-existing blockchains like Ethereum, Solana, Cardano, etc. Projects on prominent blockchains may have higher publicity and interest than novel ones.

The blockchain and protocol determine the consensus mechanism. You’ll need more time to establish security and efficiency if the blockchain is new. Projects on less efficient blockchains often have reduced interest and less profit potential.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Exploring Multiple Sources of Information

DYOR explained is not limited to one source of information. We recommend comparing insights from multiple sources. Fortunately, social media and other chat channels have strong voices that review crypto projects.

Some news outlets also lend their voice to analyzing crypto projects. These can help you establish a fair judgment before investing.

Using Reputable News Outlets and Websites

Use only reputable news outlets and websites to ensure accurate information. Start by reviewing the website’s domain. Then, you can read reviews from other readers.

Further checks include website traffic, social media presence, and an SSL certificate. Spend considerable time verifying your sources.

Leveraging Social Media and Online Communities

Social media and online trading communities are hotspots for the latest crypto projects. Most developers turn to them to generate publicity for their projects. Similarly, you can harness their insights to see where market interest lies.

Discord, Telegram, and Reddit are popular for crypto projects. Other social media channels include Instagram, YouTube, Facebook, TikTok, etc.

Distinguishing Between Facts and Hype

The table below shows significant differences between facts and hype in crypto projects:

Fact Hype It is objective and based on evidence It is subjective and often based on personal opinions We can prove facts Hypes are often exaggerations Facts are verifiable Hype can be ambiguous and open to various interpretations Avoiding FOMO (Fear of Missing Out)

Most projects design their marketing tactics to look like you are missing out. They create a false sense of something serious even when they are yet to launch.

Don’t fall for this trick. Avoid websites that hype projects and spread fear and uncertainty.

Verifying Claims and Announcements

Verify news and crucial announcements from reputable platforms. You can check major news outlets like the Washington Post, the New York Times, Yahoo News, etc.

Identifying Red Flags and Warning Signs

You’ll find red flags and warning signs if you look closely enough. Scams might resemble real deals, but they have distinguishing attributes.

Here’s how to identify red flags in crypto projects:

Recognizing Unrealistic Promises

It is probably a scam if it is too good to be true. Scammers often focus on the returns to get investors hyped up. They offer exuberant figures, like 1000 times in one month.

Your research on the project’s utility should tell you if such figures are feasible. Avoid projects with unrealistic promises.

Scrutinizing Token Distribution and Pre-sales

Tokenomics and pre-sales plans can indicate significant red flags. Projects where developers own a large chunk of the market share are often shady. Such a system will only favor them during presales.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

Incorporating DYOR into Decision-Making

“DYOR explained” is to help you make better decisions. You’ll see all the influencing factors as you gather more information about a project. Here is how to incorporate DYOR into decision-making:

Using Research to Shape Your Portfolio

Research several projects to find their strengths. Then, allocate resources according to their risk levels. You should set up portfolio trackers after allocating your capital.

Balancing DYOR with Other Factors

Besides doing your own research, other factors can be helpful. Interviews with experts and being part of a large crypto community can provide valuable insights. Others may discover things you didn’t see in your research.

Keep up with market analysis. Examine sentiments to gauge interest.

Developing a Research Routine

Research is not something you do once and drop the pen. The market and crypto landscape are always evolving. Hence, you must actively seek out new information.

The best approach is establishing a routine. You can set alerts on major platforms to receive updates on specific crypto projects or blockchains.

Allocating Time for Ongoing Research

Create time for research into your trading schedule. You don’t have to do it daily, although we recommend keeping up with daily news. Ensure the frequency is enough to keep up with markets that concern you.

Staying Updated with Project Developments

Monitor your projects closely. New developments can renew interest, creating profit pockets for scalping. Also, the project team should deliver on their milestones.

Failure to deliver milestones can be an early warning of project failure or abandonment. Keep daily tabs on them or as much as is necessary.

Knowing When to Trust Expert Opinions

Experts often have more experience. While you don’t need to trust them 100%, they can be crucial pointers in trading decisions. Some platforms, like eToro, allow expert traders to post their opinions.

Leveraging Expert Insights as a Complementary Source

Besides listening to individual experts, some platforms offer educational or training academies. You can join to see what other experts say. Some experts also drop tips on their social media channels.

Complement expert advice with your research and technical analysis. Find a middle ground if they don’t agree.

Avoiding Blindly Following Recommendations

Don’t accept recommendations without doing your research. Most experts will display their credibility with previous predictions. Take it in good faith, but consider your risk tolerance before investing.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

DYOR as a Lifelong Skill

Doing your own research continues as you trade. Innovations are up and running, and so should you. Keep up with them to recognize profit opportunities.

Here’s what you should do to keep DYOR as a lifelong skill:

Continuously Improving Research Skills

We expect your speed to be slow when you first research. However, you should pick up the pace. Find new ways to obtain information faster.

AI tools, like GPT-4, can summarize whitepapers and bring out the points you need. Some platforms use artificial intelligence to analyze markets faster.

Improve your authenticity as you trade. Subscribe to more reputable platforms to receive authentic and filtered news.

Adapting to Market Changes and New Projects

The crypto market is volatile and evolving. Bitcoin ordinals debuted in early 2023, marking a new era for the blockchain. You must keep up to stay relevant.

Find new projects that reflect current market realities. Also, pay attention to new federal regulations. Adjust your portfolio to fall within the law.

DYOR Explained: eToro Complete Guide

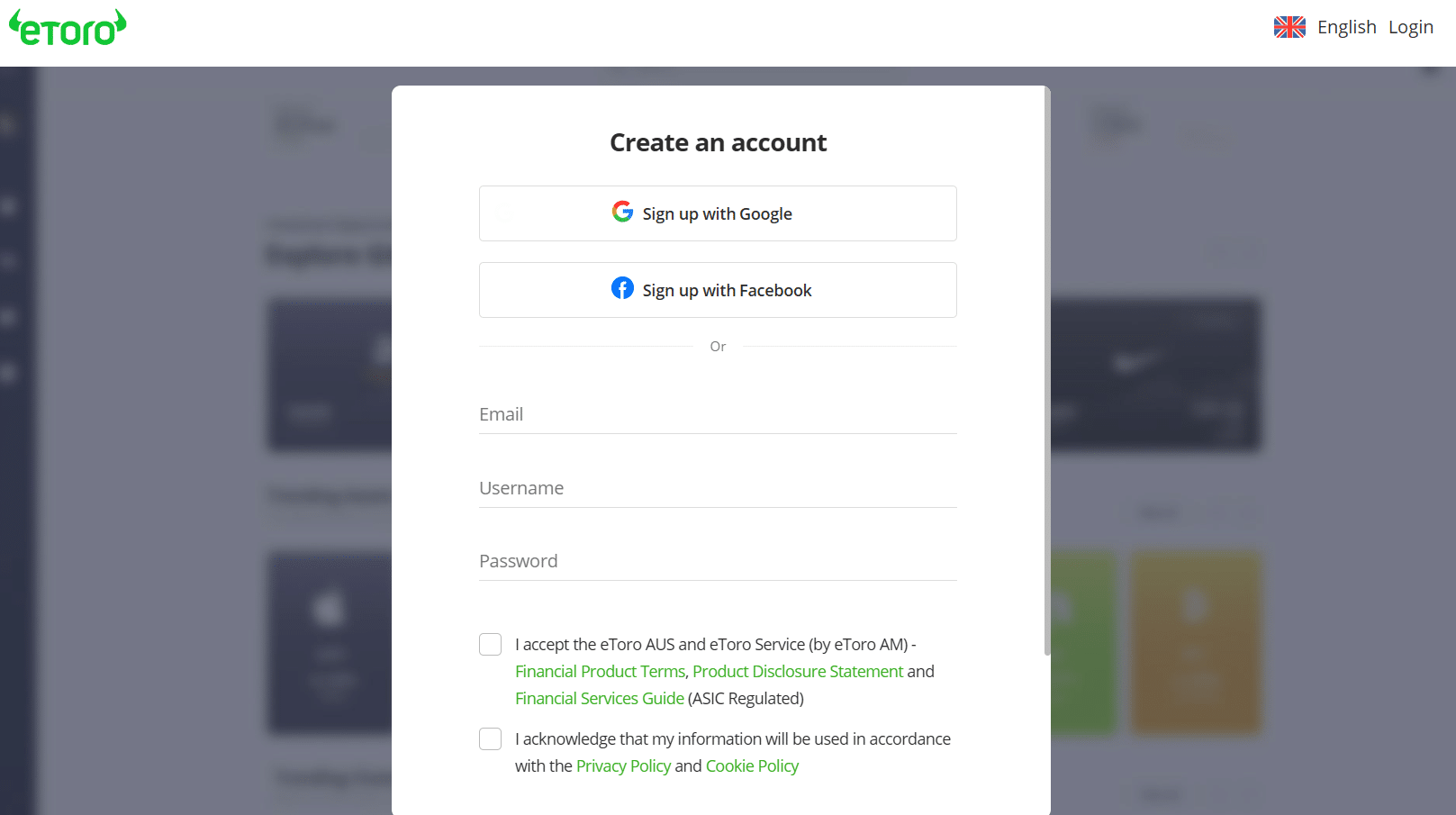

You’ve seen DYOR explained with first-hand use cases. The next step is practicing what you’ve learned. We recommend eToro’s $100,000 virtual account for practice.

eToro offers access to Android and iOS devices. You can trade on the website or use its dedicated mobile app for your device. Most importantly, it has the tools for technical analysis and trader insights.

Note: Only cryptocurrencies eToro customers in the United States will be able to trade on the platform will be Bitcoin, Bitcoin Cash, and Ethereum.

Here’s how to set up your eToro account and start trading:

Step 1: Visit the websiteOpen the website on your PC or mobile device. Use the link we’ve provided to access the official website. Skip the download page and go to the home page.

Step 2: Open a new accountClick “Join eToro,” “Start Investing,” or “Buy Crypto” to open the registration page. Fill out the registration form with valid details.

Your email is crucial for account verification. Hence, use a valid email. You can autofill your details through your Gmail or Facebook accounts.

Step 3: Complete email verificationEnter the verification code on the verification page. Do that as soon as you receive the code. eToro allows a limited time for the code’s validity.

Step 4: Verify your identityUpload your ID, driver’s license, or passport to prove your identity. Also, upload your utility bill as proof of address.

Enter your phone number and input the verification code. Your account should be ready for deposits and withdrawals.

Step 5: Deposit to tradeFund your account to start trading. We recommend starting with the $100,000 virtual account.

DYOR Explained: How and why to do it? – Conclusion

Staying ahead in the crypto market requires constant research. Complement your research with expert opinions instead of relying entirely on them. Develop a routine and set up news alerts to follow the latest developments in your preferred areas.

eToro supports cryptocurrency trading and analysis. Register on eToro to start trading.

Disclaimer: Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

References

- https://www.prnewswire.com/news-releases/crypto-investors-lost-3-5-billion-to-scammers-in-2022–privacy-affairs-study-reveals-301692579.html

- https://finbold.com/revealed-historys-10-biggest-crypto-rug-pulls/

- https://www.forbes.com/health/mind/the-psychology-behind-fomo/

- https://edition.cnn.com/2022/02/14/business/money/market-volatility/index.html

- https://www.coininsider.com/blockchain-update-tips/

FAQs

What is the DYOR strategy?

This strategy involves conducting detailed research into crypto projects. It begins with fundamental research and ends with technical analysis.

Why is it important to DYOR?

Doing your own research can help you filter out fake opinions and tricky marketing. You’ll identify red flags and avoid scams.

Why is DYOR important in crypto?

The crypto market is volatile, risky, and filled with scams. Personal research helps keep the noise, especially the hype, out. It focuses on facts.

What is the meaning of DYOR?

DYOR means “DYOR stands for doing your own research. It involves exploring whitepapers, technical platforms like GitHub, and news websites for authentic information.

Jeremiah Awogboro

View all posts by Jeremiah AwogboroJeremiah Awogboro is an experienced content writer with over 8 years of experience. He has a qualified MBChB degree and a keen interest in the stock market and the finance industry. His background in the industry has provided him with valuable experience in this field. Awogboro is dedicated to assisting and reaching out to as many people as possible through his writing. In his spare time, he enjoys music, football, traveling, and reading.

VISIT ETOROYour capital is at risk. Other fees apply. For more information, visit etoro.com/trading/fees.stockapps.com has no intention that any of the information it provides is used for illegal purposes. It is your own personal responsibility to make sure that all age and other relevant requirements are adhered to before registering with a trading, investing or betting operator. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice.By continuing to use this website you agree to our terms and conditions and privacy policy.

Trading is risky and you might lose part, or all your capital invested. Information provided is for informational and educational purposes only and does not represent any type of financial advice and/or investment recommendation.

Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers.

© stockapps.com All Rights Reserved 2026