In 2020, Netflix recorded 36 million new subscribers following the global pandemic. With most of the world staying indoors and working from home, it’s no surprise that the American streaming and production company grew by bounds.

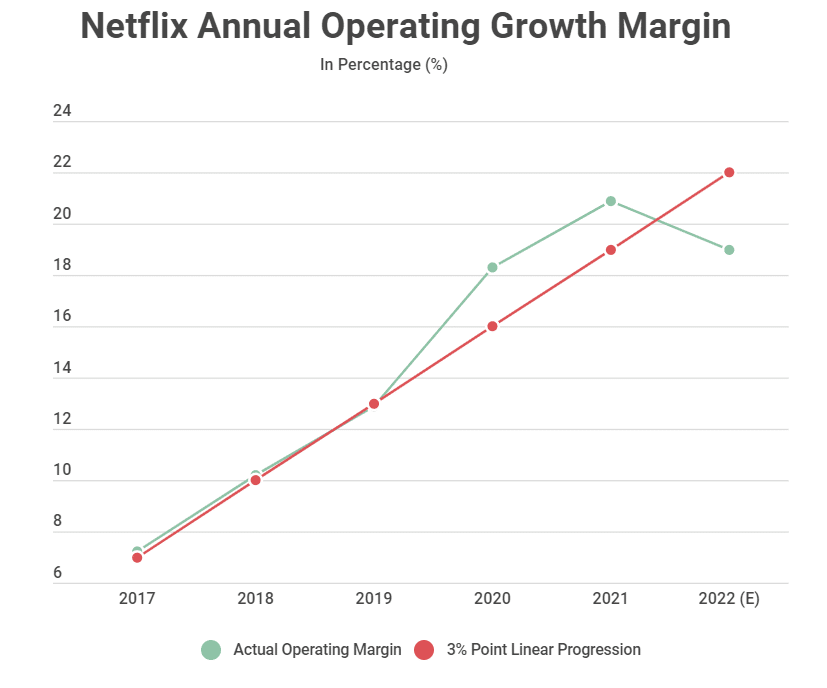

However, recent data indicates that the boom was only short-lived. According to a data presentation by Stockapps.com, 2021 wasn’t quite as significant for Netflix as the company made a dramatic slowdown. Further, things don’t quite look up as forecasts show an expected decline in the company’s operating margin in 2022 to 19%; down from 21% in 2021.

While making her remarks on the findings, Edith Reads from Stockapps.com said that although Netflix was able to match analysts’ prediction of the annual revenue, it spent more on content in the hopes of gaining subscribers. This, coupled with other factors, led to the company’s expected decline in the 2022 operating margin.

“Clearly, Netflix gained a lot in terms of new subscribers in 2021. But the company’s performance is now slowing down as the excitement of staying and working from home dies down. Even with the expected decline in operating margin, Netflix maintains they are still on the right path, and it’s probably still too early for investors to chicken out,” Edith added.

US dollar’s value appreciation costs Netflix $1 billion

Netflix points out that the dollar’s stellar performance over the last six months of the year against other currencies plays a significant role in the company’s declining profits.

The company points out that is intent on restoring its acquisition level to pre-covid levels and focussed on creating more content of higher quality. This also means higher costs for Netflix. Since most of the company’s expenses are in US dollars, Netflix will end up losing about $1 billion in expected 2022 revenue, which translates to a roughly 2% decline in operating margin from 2021’s 21%.

Despite the expected decline, Netflix remains steadfast in its long-term growth strategy. The company will adjust its pricing for a stronger US dollar world in the medium term. However, Netflix is seeking to invest in the company appropriately in the short term without being victim to the seasonal fluctuations.

Tough competition calls for drastic measures

The earnings report by Netflix also acknowledges that there’s tough competition in the entertainment scene, especially in recent months. Entertainment companies worldwide are looking for ways to capture larger markets by transitioning to streaming services.

Still, Netflix has shown continued growth in global paid streaming memberships, which remain the company’s largest revenue source. The streaming services company continues to thrive even in markets where the competition is also emerging.

That said, the company is looking to improve its services to leverage the available room for growth. Even in the Us, which is Netflix’s biggest market, the company still has less than 10% of total TV screen time.

Question & Answers (0)