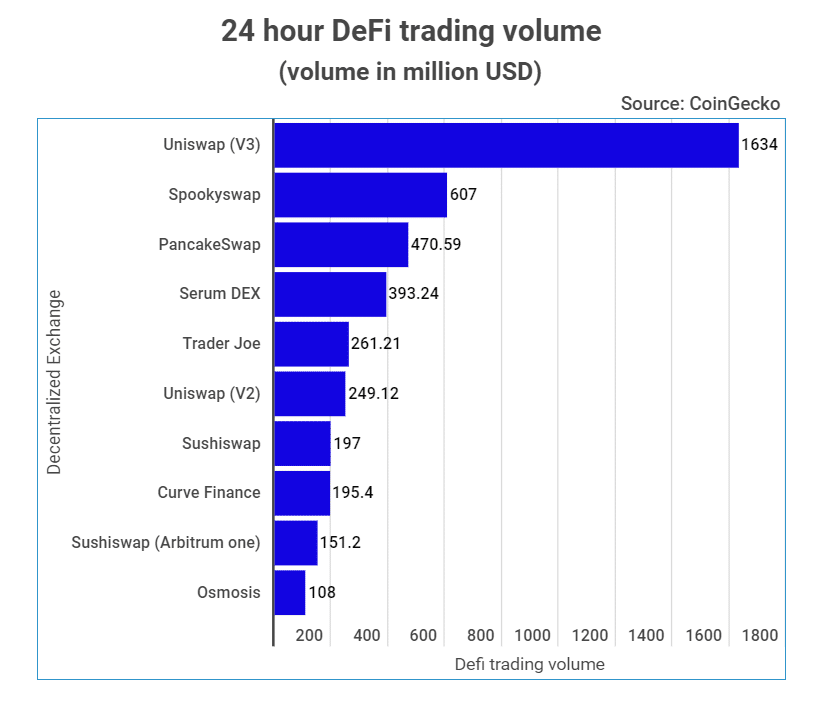

Ten decentralized exchanges (DEXs) control a majority of the transactions in the decentralized finance (Defi) space. According to data presented by stockapps.com, the 10 control daily transactions amounting to $4.2 billion. That gives them a 72 percent share of the roughly $5.8B DeFi daily trading volume.

Stockapps.com’s Edith Reads has been analyzing the data. She holds, “Since breaking out in 2020, the DeFi sector has been on an upward trajectory. That growth has been buoyed by the increased regulation of centralized exchanges. Again, DEXs offer a wide variety of crypto trading pairs compared to centralized ones.”

Ruling the roost

Uniswap( v3) dominates DeFi transactions. At the time of writing, the DEX had moved 467 coins worth nearly $1.6 billion. That figure amounts to 28 percent of the DeFi sector’s daily total traded volume.

Following in the second and third positions were SpookySwap and PancakeSwap. The former facilitated the exchange of 61 cryptos for more than $600 million. Meanwhile, the latter moved 3984 coins for close to $470.6 million.

Serum DEX, Trader Joe, and Uniswap (v2) took the fourth to sixth spots. Serum enabled the trade of 71 coins for about $393 M. On its part, Trader Joe oversaw transactions amounting to nearly $261M. Meanwhile, Uniswap (v2) handled trades exceeding $249M.

Additionally, Sushiswap, Curve Finance, and Osmosis made it to the top ten dominant DEXs. The exchanges handled transactions involving some 2,200 coins. Those transactions amounted to over $500 million.

The surging popularity of DEXs

The advent of decentralized finance has seen a rise in the popularity of decentralized exchanges. One reason explaining this growth is that DEXs are non-custodial. That means that the user has complete control of their funds.

That a user retains full ownership of the asset is a boon for many. Besides the feeling of freedom, it confers the benefits of censorship-free and trustless cryptos exchange. By cutting off intermediaries from transactions, DEXs make exchanges affordable.

Furthermore, DEXs have proven to be more secure than their centralized counterparts. That’s because they don’t control the users’ digital assets. This aspect reduces exposure to malicious individuals that may exploit the exchange to drain your crypto holding.

DEXs are also popular with crypto project owners because of their less stringent approval procedures. This ease of onboarding guarantees users unparalleled liquidity and crypto trading pairs.

Question & Answers (0)